42 zero coupon bonds definition

How Do Zero Coupon Bonds Work? - SmartAsset Zero coupon bonds can be issued by f inancial institutions, c orporations, and f ederal agencies or municipalities. Some of those bonds are initially issued as zero coupon bonds. Others become zero coupon bonds only after a financial institution strips them of their coupons and repackages them. And you still pay taxes on the money you earn from ... Zero coupon bond definition — AccountingTools An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds. Because payments are delayed to maturity, there is a greater chance of fluctuations in the price of a zero coupon bond over its lifespan that reflect changes in interest rates. This presents a higher risk to investors of not gaining expected returns ...

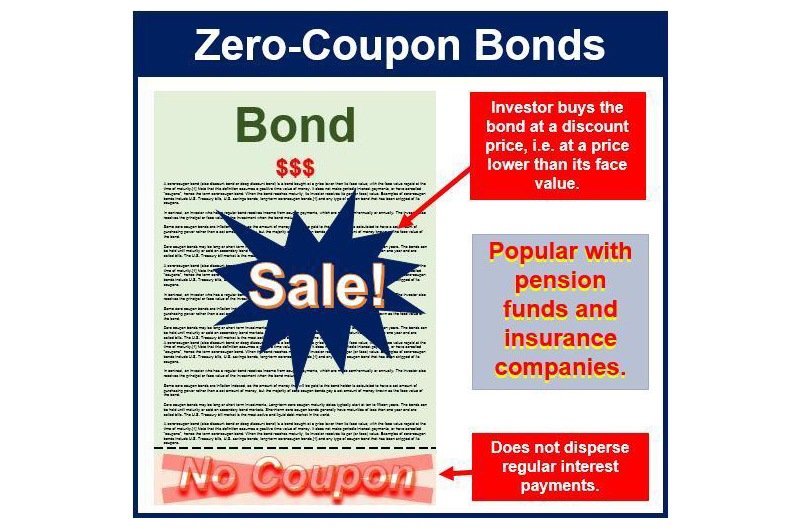

zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition. A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value. Rather than receiving interest, an investor's compensation will be the difference between the discounted price at which the bond was purchased and the price the investor receives when ...

Zero coupon bonds definition

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... What are Zero-Coupon Bonds? A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is … Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. › terms › bBond Definition - Investopedia Feb 23, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

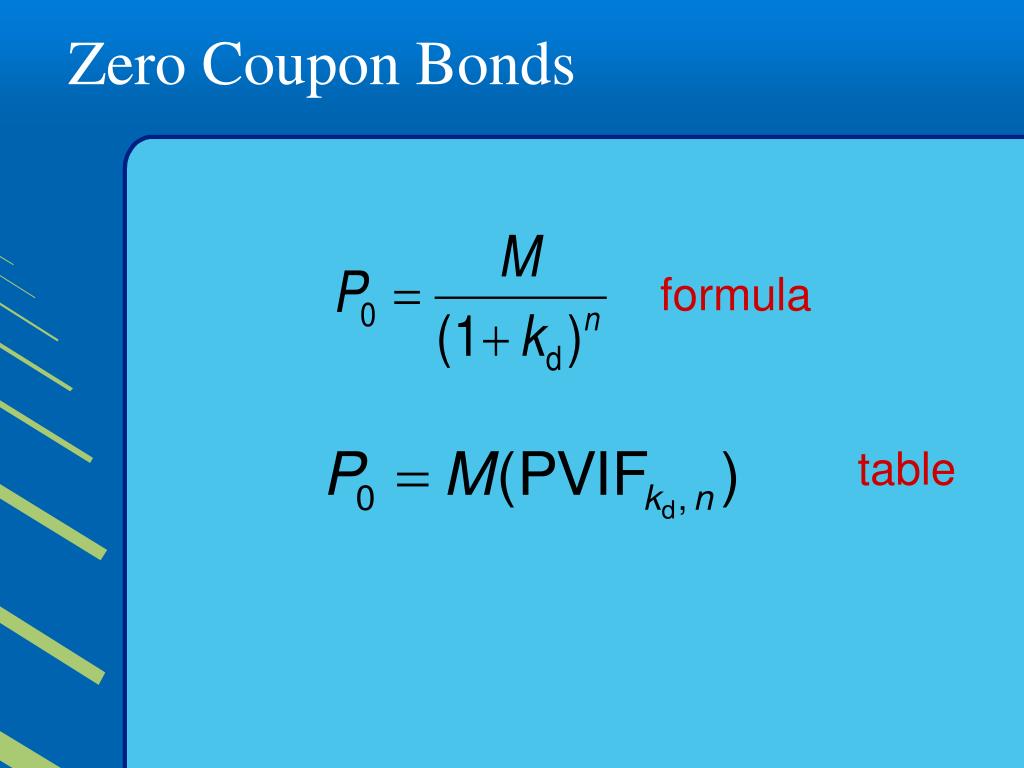

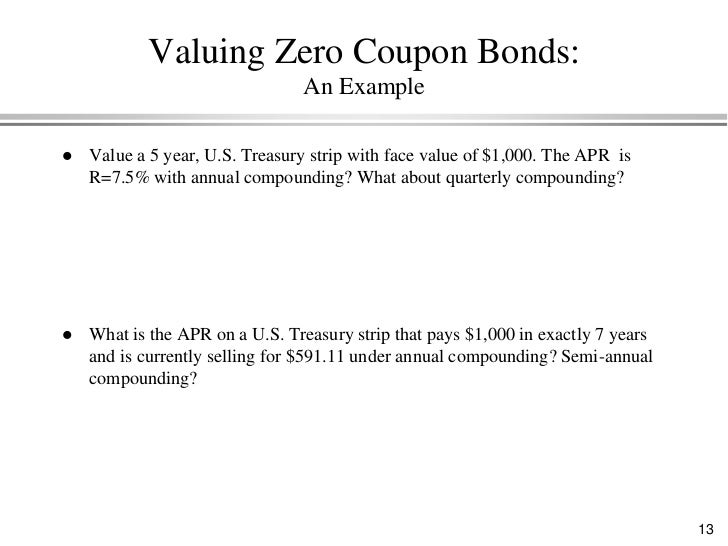

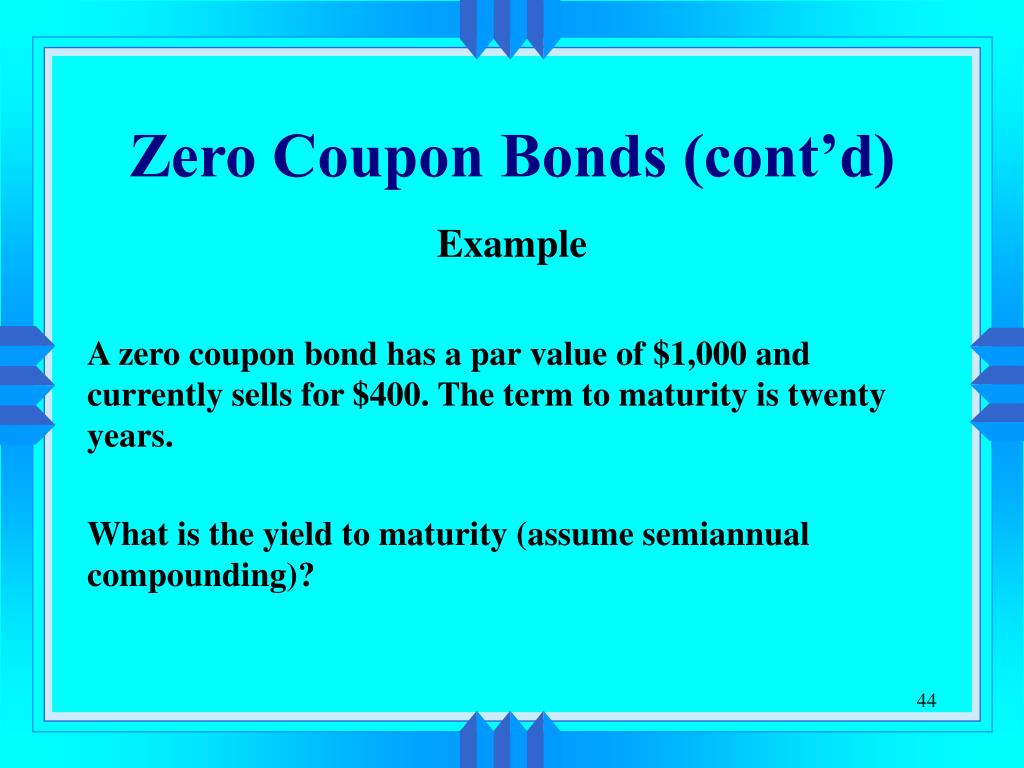

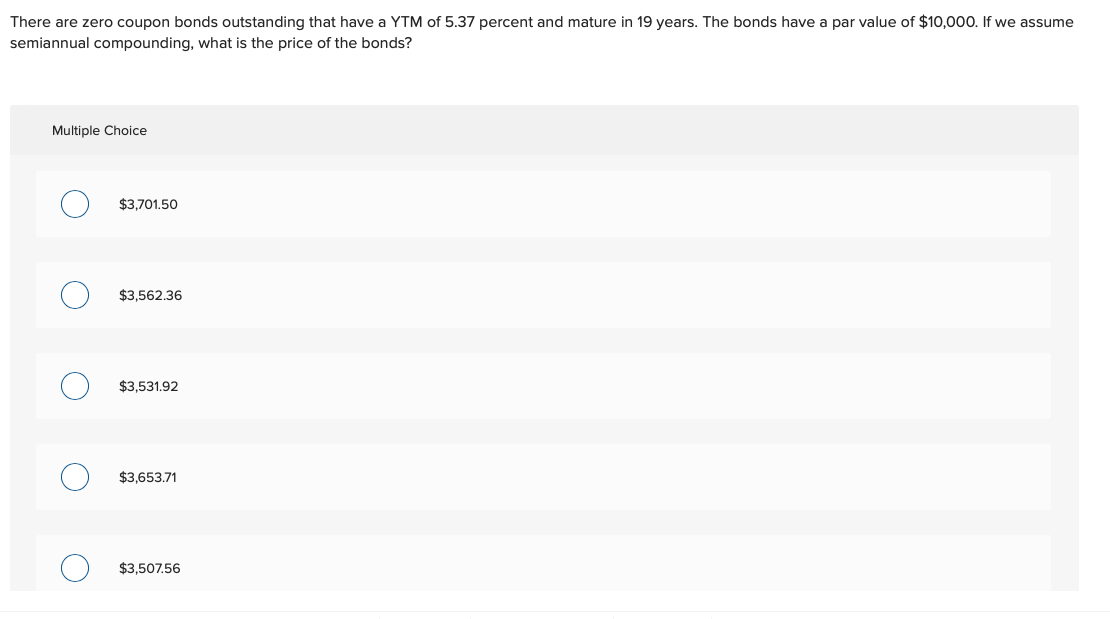

Zero coupon bonds definition. › what-are-corporate-bonds-3305604Corporate Bonds: Definition, Type, Size of Market Jul 12, 2021 · Zero-coupon bonds withhold interest payments until maturity. The investor must pay taxes on the accrued value of the interest payment, just as if they were being paid. Convertible bonds are like plain vanilla bonds, but these allow you to convert them to shares of stock. If stock prices rise, the value of the bonds will increase. Zero-coupon bond financial definition of Zero-coupon bond zero-coupon bond. A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from ... Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ...

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Zero Coupon Bond | Definition, Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ... What is a Zero-Coupon Bond? Definition and Meaning Definition and Meaning. A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy. A zero-coupon bond has no periodic interest ... Zero Coupon Bonds financial definition of Zero Coupon Bonds A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

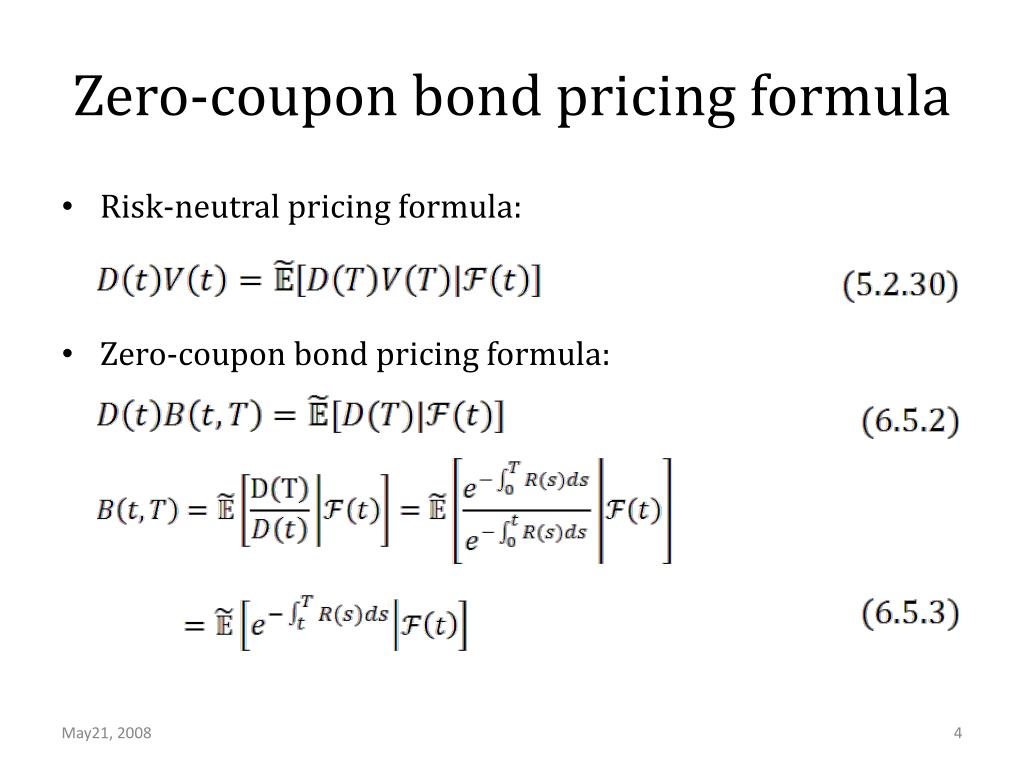

Advantages and Risks of Zero Coupon Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly if the Fed raises interest rates. They also ... › terms › cCoupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

What Is a Zero-Coupon Bond? | The Motley Fool Understanding zero-coupon bonds. Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the ...

Zero-Coupon Bonds - Accounting Hub Definition. A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so ...

Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a "T-Bill," a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula

Zero Coupon Bond Definition | Law Insider Define Zero Coupon Bond. Any debt security that by its terms (a) does not bear interest for all or part of the remaining period that it is outstanding, (b) provides for periodic payments of interest in Cash less frequently than semi-annually or (c) pays interest only at its stated maturity.

accountinguide.com › accounting-for-bondsAccounting for Bonds | Premium | Discount | Example ... Accounting for Bonds Definition. Bonds Payable is the promissory note which the company uses to raise funds from the investor. Company sells bonds to the investors and promise to pay the annual interest plus principal on the maturity date. It is the long term debt which issues by the company, government, and other entities.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

What are Zero coupon bonds? - INSIGHTSIAS These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par. What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank.

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bond: Definition, Formula & Example - Study.com A zero coupon bond is one option for investors to consider. Learn the definition of zero coupon bonds, discover the formula used to calculate pricing, and check understanding with an example.

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example For instance, if a zero-coupon bond was sold at a $100 discount and matures in four years, its holder would have to pay the applicable bond interest tax rate on $25 worth of the bond's total $100 ...

Post a Comment for "42 zero coupon bonds definition"