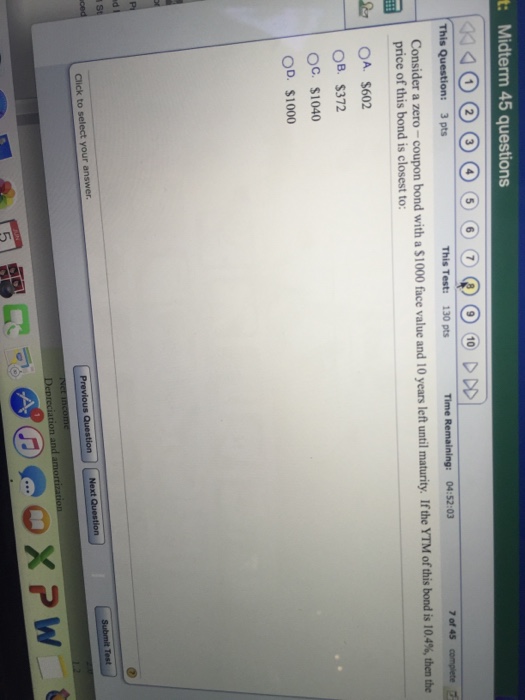

45 zero coupon bond face value

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Zero coupon bond face value

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate/2) ^ time to maturity*2 Price of Zero-Coupon Bond = $10,000 / (1.025) ^ 20 = $6,102.77 With semiannual compounding, we see the bond...

Zero coupon bond face value. 4. A 10 year zero-coupon bond with a Face Value of \( | Chegg.com Expert Answer Transcribed image text: 4. A 10 year zero-coupon bond with a Face Value of $1000 is sold at a price of $600. If the annual inflation rate is expected to be 2.5%, what is the expected real interest rate on this investment? If the actual inflation rate turns out to be 4%, would it benefit the issuer or the investor? Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317 How Do Zero Coupon Bonds Work? - SmartAsset When the bond matures, the bondholder is repaid an amount equal to the face value or par value of the bond. Bonds are sometimes issued at a discount below its par value. For example, if you buy a bond at a discount for $940, the par value may still be $1,000. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero coupon Bonds — Quicken Answers J_Mike SuperUser September 1 For background, zero coupon bonds are purchased at steep discount to face value. Interest is earned on the bond and is paid at maturity when the bond is reddened at face value. To record this in quicken requires 3 transactions; 1) An Interest Income transaction - for the amount of interest, Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53. Solved A zero coupon bond with a face value of $1,000 is | Chegg.com A zero coupon bond with a face value of $1,000 is issued with an initial price of $410.50. The bond matures in 25 years. What is the implicit interest, in dollars, for the first year of the bond's life? Use semiannual compounding. Expert Answer 100% (4 ratings) Calculation of implicit interest: PV = $410.5 … View the full answer What Is the Face Value of a Bond? - SmartAsset Jan 15, 2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

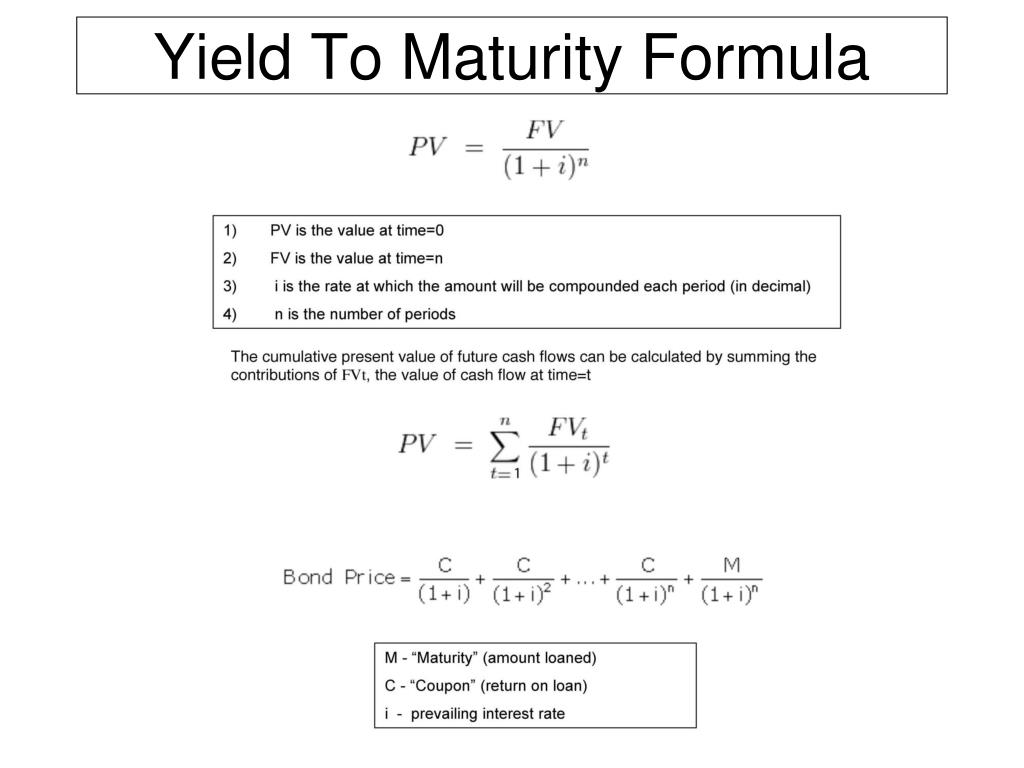

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks What are zero-coupon bonds? - moneycontrol.com What are zero-coupon bonds? Sep 07, 05:09. Zero coupon bonds are issued at a discount to the face value of the bond. They do not pay interest during the tenure of the security. The investor of the ... Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Zero-Coupon Bond Pricing Example. If an investor wanted to make 5% imputed interest on a zero-coupon bond with a face value of $15,000 that matures in four years, how much would they be willing to ...

Zero Coupon Bond: Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Q12 a zero coupon bond has a face value of 100 000 Q12 A zero coupon bond has a face value of $100 000 and matures in three years. If the netproceeds from issuing the bond were $90 000, the implied annual cost is: a. 5.00% b. 3.51% c. 3.58%d. 3.57%. d is correct. See formula 7.2 on page 219. Note that the discount rate on a zero coupon bond can be determined using the following equation: rb ...

Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ...

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia (Face value/ current market price) * (1/years to maturity) - 1 Features of Zero-Coupon Bond The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity.

What are Zero Coupon Bonds? Types, Advantages & Disadvantages Zero Coupon Bond is a debt security shield that pays no interest. Instead, the zero-coupon bonds are traded with huge discounts yet return good profits on getting mature on their face value. Their purchasing price and par value determine the return of these coupons. Zero Coupon Bonds do not pay any interest during the life of the bonds.

Post a Comment for "45 zero coupon bond face value"