41 calculate coupon rate in excel

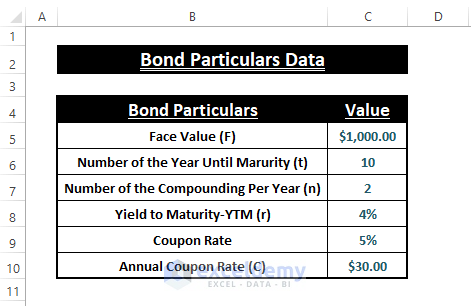

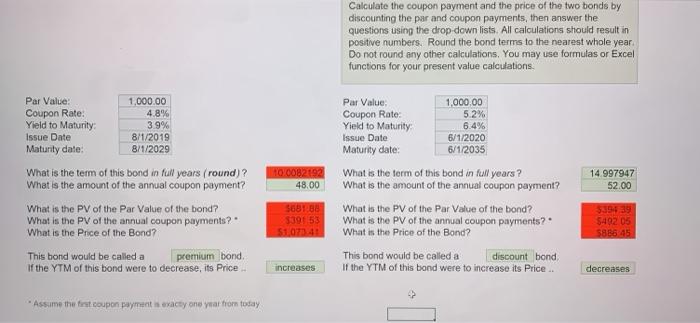

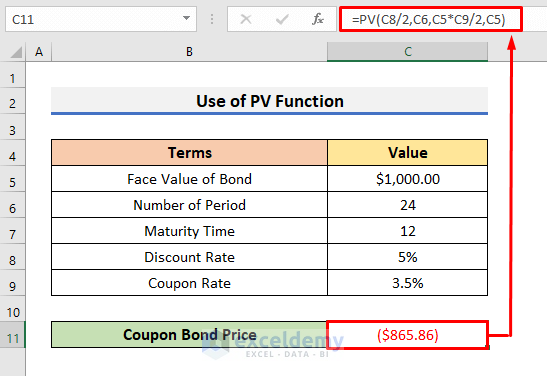

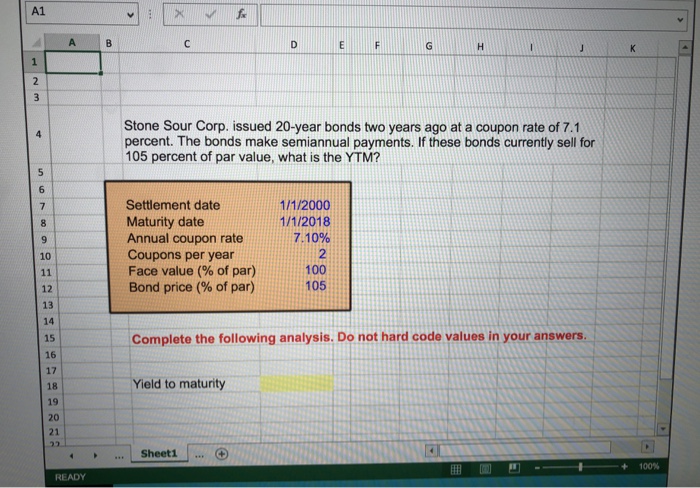

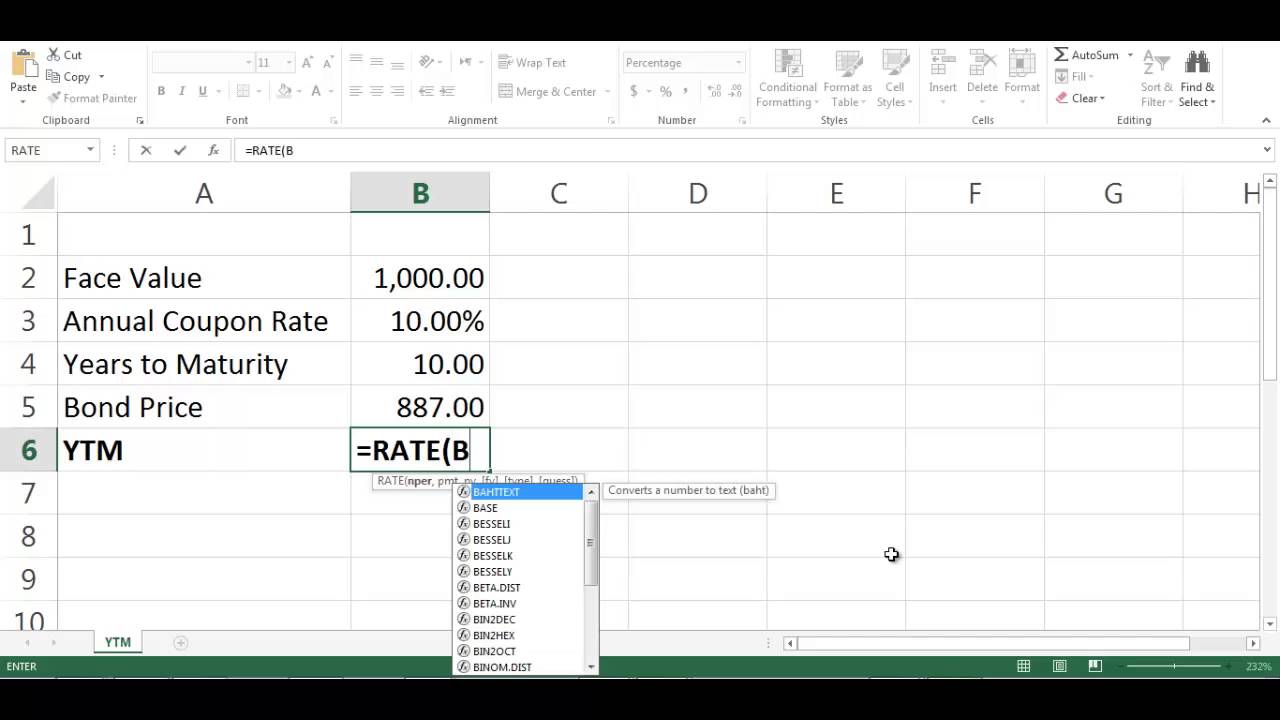

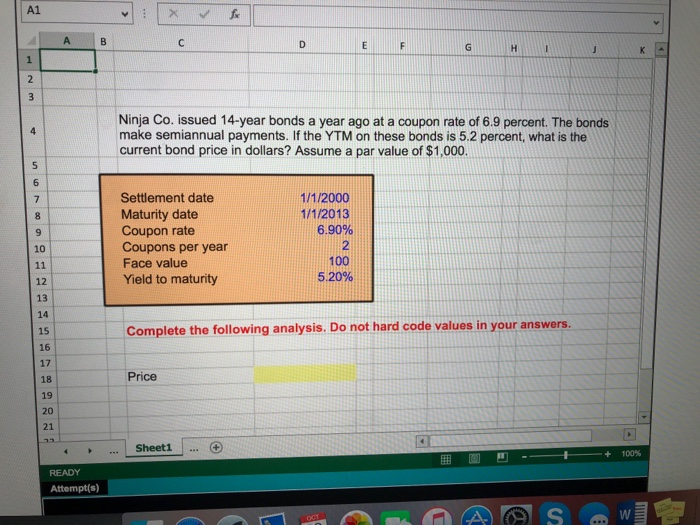

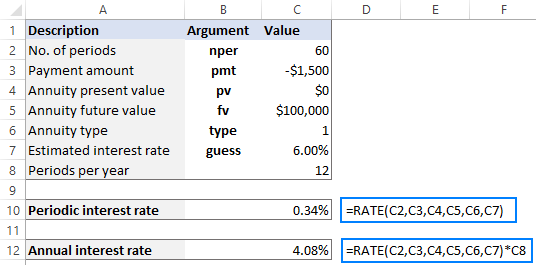

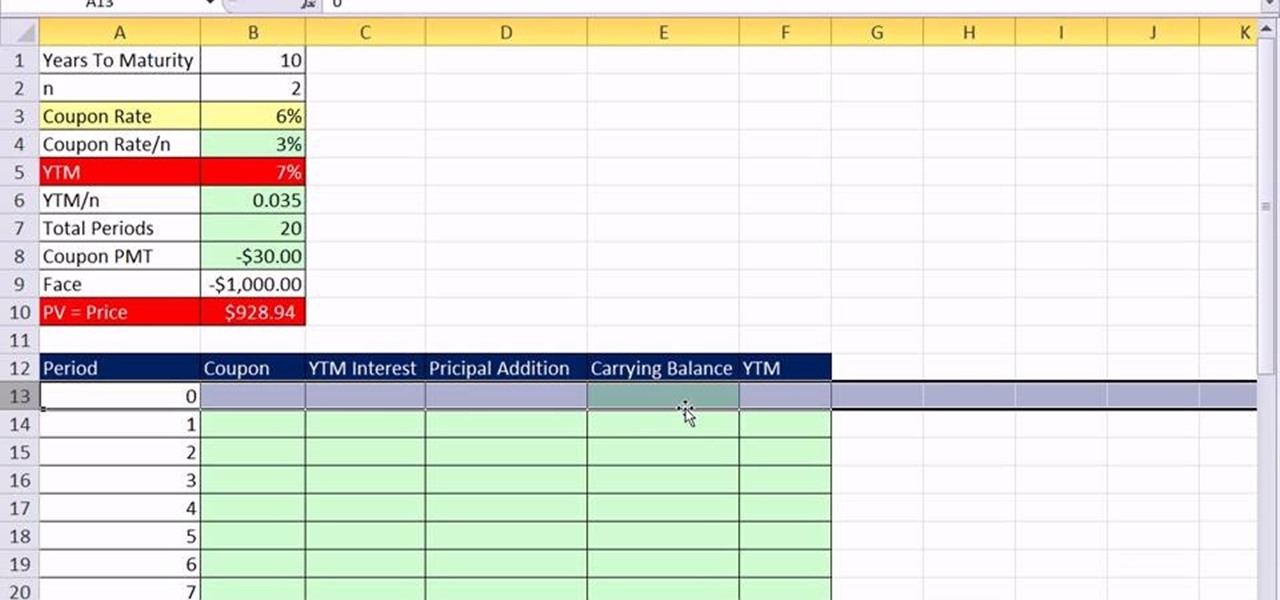

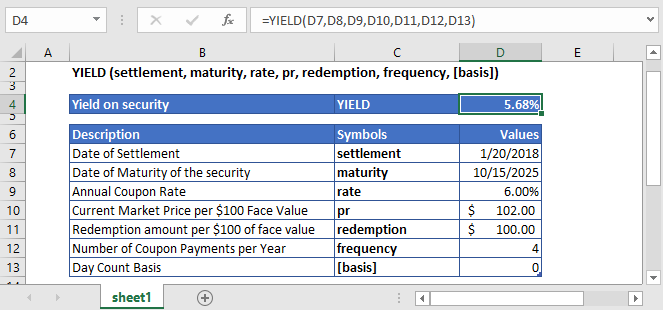

How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% annually with a maturity date in 20 years and a discount rate of 4%. The coupon is paid semi-annually: Jan. 1 ... Current Yield Formula | Calculator (Examples with Excel Template) Let us take the example of a 10-year coupon paying a bond that pays a coupon rate of 5%. Calculate the current yield of the bond in the following three cases: Bond is trading at a discounted price of $990. Bond is trading at par. Bond is trading at a premium price of $1,010.

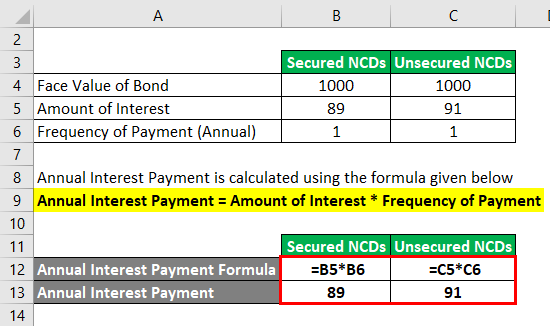

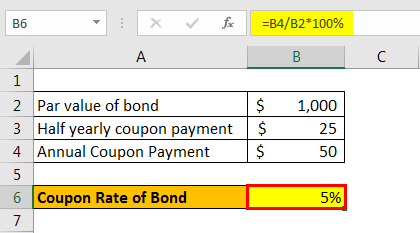

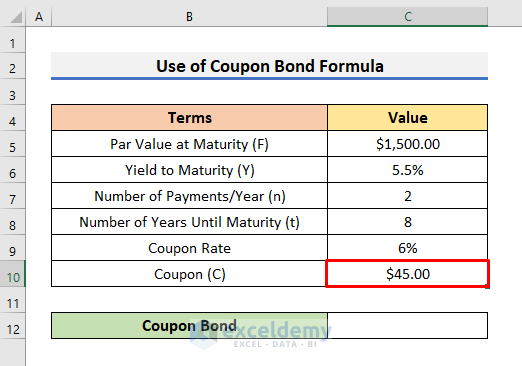

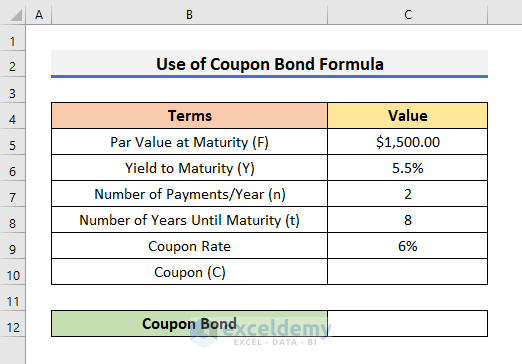

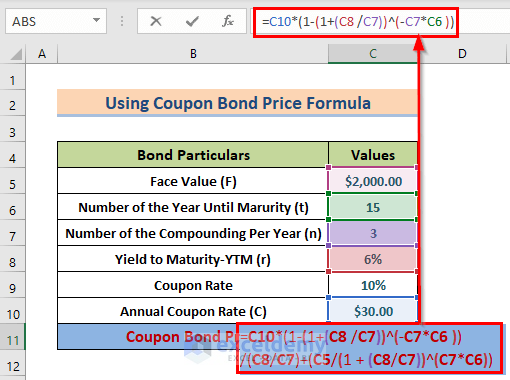

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Step 3: In the final step, the amount of interest paid yearly is divided by the face value of a bond in order to calculate the coupon rate. Examples of Coupon Rate Formula (With Excel Template) Let’s take an example to understand the calculation of the Coupon Rate formula in a better manner.

Calculate coupon rate in excel

Capitalization Rate Formula | Calculator (Excel template) Capitalization rate should not be a single factor in estimating whether a property is worth investing in. Recommended Articles. This has been a guide to Capitalization Rate formula. Here we discuss How to Calculate Capitalization Rate along with practical examples. We also provide a Capitalization Rate Calculator with downloadable excel template. Cost of Goods Sold (COGS) Explained With Methods to Calculate It Aug 22, 2022 · Cost of Goods Sold - COGS: Cost of goods sold (COGS) is the direct costs attributable to the production of the goods sold in a company. This amount includes the cost of the materials used in ... How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · However, calculating the coupon rate using Microsoft Excel is simple if all you have is the coupon payment amount and the par value of the bond. What Is the Coupon Rate? First, a quick definition ...

Calculate coupon rate in excel. Coupon Rate: Formula and Bond Calculation (Step-by-Step) If we multiply the coupon payment by the frequency of the coupon, we can calculate the annual coupon. Annual Coupon (C) = $25,000 x 2; Annual Coupon (C) = $50,000; With all the inputs ready, we can now calculate the coupon rate by dividing the annual coupon by the par value of the bonds. Coupon Rate (%) = $50,000 / $1,000,000; Coupon Rate (%) = 5% How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · However, calculating the coupon rate using Microsoft Excel is simple if all you have is the coupon payment amount and the par value of the bond. What Is the Coupon Rate? First, a quick definition ... Cost of Goods Sold (COGS) Explained With Methods to Calculate It Aug 22, 2022 · Cost of Goods Sold - COGS: Cost of goods sold (COGS) is the direct costs attributable to the production of the goods sold in a company. This amount includes the cost of the materials used in ... Capitalization Rate Formula | Calculator (Excel template) Capitalization rate should not be a single factor in estimating whether a property is worth investing in. Recommended Articles. This has been a guide to Capitalization Rate formula. Here we discuss How to Calculate Capitalization Rate along with practical examples. We also provide a Capitalization Rate Calculator with downloadable excel template.

Post a Comment for "41 calculate coupon rate in excel"