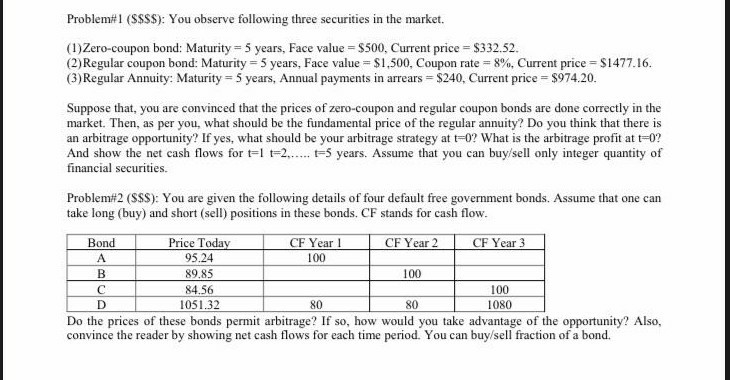

44 zero coupon bonds advantages

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

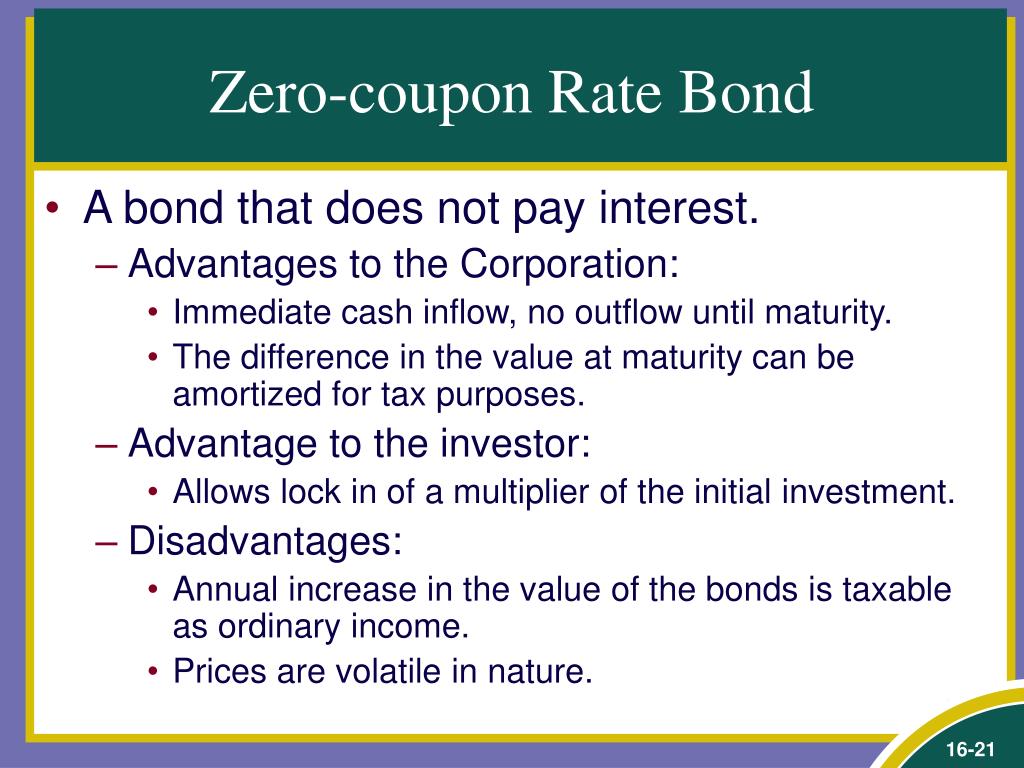

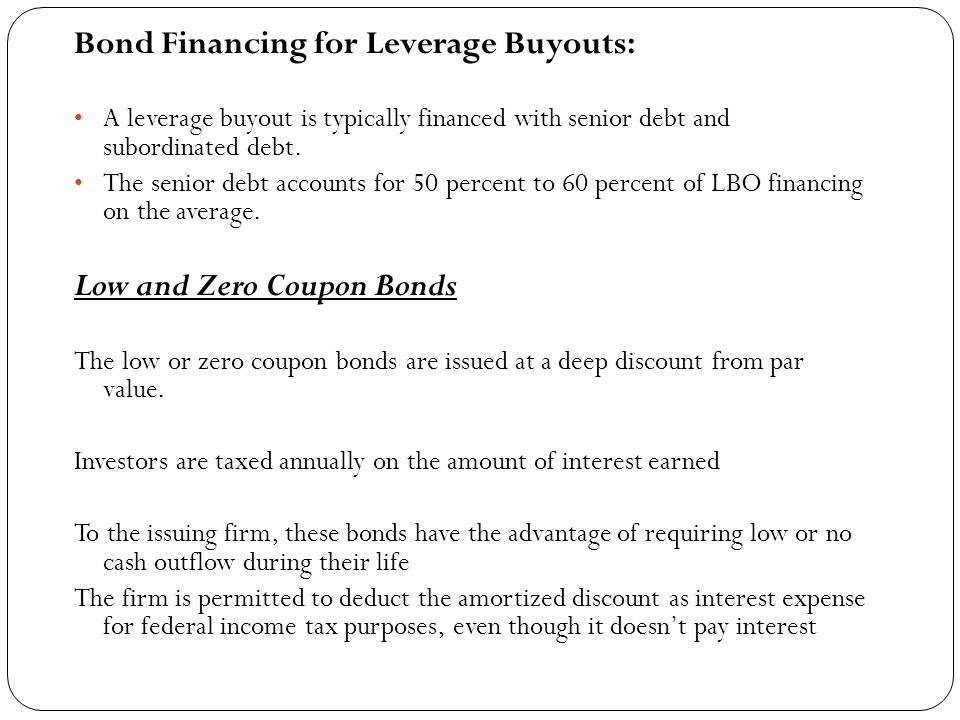

Zero coupon bonds what are the advantages and - Course Hero "Low-coupon bonds and zero-coupon bonds arelong-term debt securities that are issued at a deep discount from par value. Investors aretaxed annually on the amount of interest earned, eventhough much or all of the interestwill not be received until maturity. The amount of interest taxed is the amortized dis-count.

Zero coupon bonds advantages

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? The primary advantages are that you are purchasing the bond at a significant discount to its face value (like a US Savings Bond) and gradually accrues in value until it reaches its face value. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Advantages #1 - Predictability of Returns This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities, etc.

Zero coupon bonds advantages. Aerocity Escorts & Escort Service in Aerocity @ vvipescort.com Aerocity Escorts @9831443300 provides the best Escort Service in Aerocity. If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us.. What Is The Advantage Of Investing In A Zero Coupon Bond - Atish Lolienkar Advantage of zero coupon bond Guaranteed return Zero coupon bonds are issued for a rate much lower than the actual face value of the bond. Thus, it is evident that the investor will get the face value once maturity. The final price and the time when the investor will receive is defined, making it a guaranteed source of return on maturity. What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right...

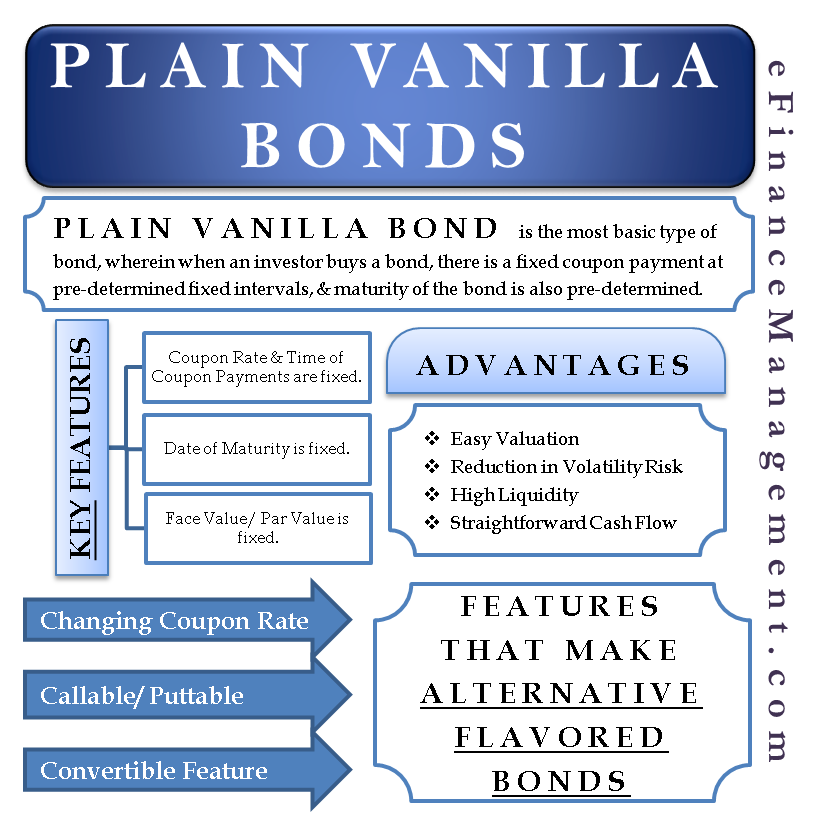

What is a zero-coupon bond? What are the advantages and risks? One advantage is that if rates are high, you essentially lock in that rate for the maturity of the bond. if rates go down, they gain value quickly. I can think of two disadvantages. One is that they lose more value if rates go up. The second is the tax treatment. How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. Advantages and Disadvantages of Bonds | Boundless Finance - Course Hero Zero coupon bonds: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. ... Advantages of Bonds Bonds have a clear advantage over other securities. The volatility of bonds (especially short and medium dated bonds) is ... Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

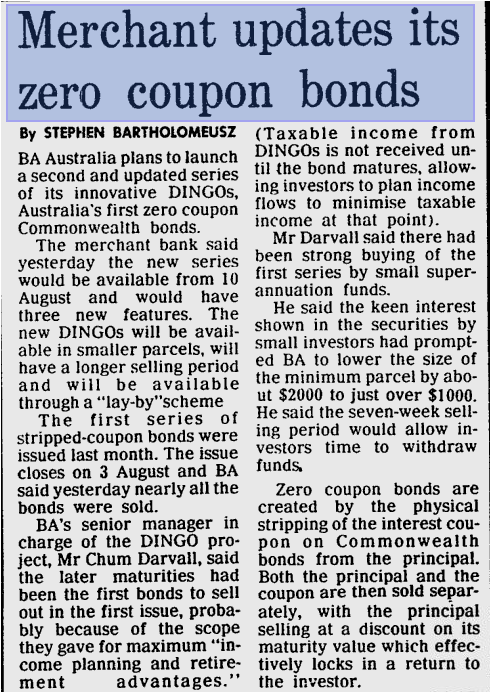

Zero-Coupon Bond - Definition, How It Works, Formula Extending the idea above into zero-coupon bonds - an investor who purchases the bond today must be compensated with a higher future value. Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds 25+ Year Zero Coupon U.S. Treasury Index Exchange ... - PIMCO Sep 30, 2022 · Aims to achieve the benefits of exposure to a long U.S. Treasury fund. The fund aims to achieve, before fees and expenses, the yield and duration exposure inherent in a long U.S. Treasury fund. Pros and Cons of Zero-Coupon Bonds | Kiplinger These bonds don't make regular interest payments. Instead, they're sold at a big discount to face value; when they mature, you collect the full amount. Their big advantage is that you know how ... Zero-Coupon Bond - an overview | ScienceDirect Topics In the US market zero-coupon bonds or "zeros" were first issued in 1981 and initially offered tax advantages for investors, who avoided the income tax charge associated with coupon bonds. 6 However the tax authorities in the US implemented legislation that treated the capital gain on zeros as income, thus wiping out the tax advantage. The ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

A Complete Guide to Investing in TIPS and I Bonds (2022) Oct 12, 2022 · Investing in Series I Savings Bonds. Series I Savings Bonds, also known as I bonds, can only be bought directly from the U.S. Treasury Department. They are not bought and sold in the secondary market. The bonds are available electronically or in paper form, and were first issued in 1998. The TreasuryDirect website is the easiest place to buy ...

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia The municipal zero-coupon bonds can help you save tax on the interest income. Advantages of Zero-Coupon Bonds Meet Long-term Goals Zero-Coupon Bonds don't offer regular interest. Instead, the earned interest is accumulated and paid at the maturity. It thus helps create funds that can help meet your long-term goals. Fixed Returns

Mortgage-backed security - Wikipedia The key difference between covered bonds and mortgage-backed or asset-backed securities is that banks that make loans and package them into covered bonds keep those loans on their books. This means that when a company with mortgage assets on its books issues the covered bond, its balance sheet grows, which would not occur if it issued an MBS ...

What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia What are the advantages of a Zero-Coupon Bond? Zero-Coupon Bonds prove to be a safer option as compared to other fixed income instruments. They render good returns at the time of maturity and if interest rates fall dramatically, there is an option to sell them in secondary markets. Source: Tavaga. Home. Pricing. FAQs. Under The Hood. Blog.

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons.

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

What Is a Zero-Coupon Bond? - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead...

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

Achiever Papers - We help students improve their academic ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Advantages #1 - Predictability of Returns This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities, etc.

What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? The primary advantages are that you are purchasing the bond at a significant discount to its face value (like a US Savings Bond) and gradually accrues in value until it reaches its face value.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "44 zero coupon bonds advantages"