45 coupon rate and yield

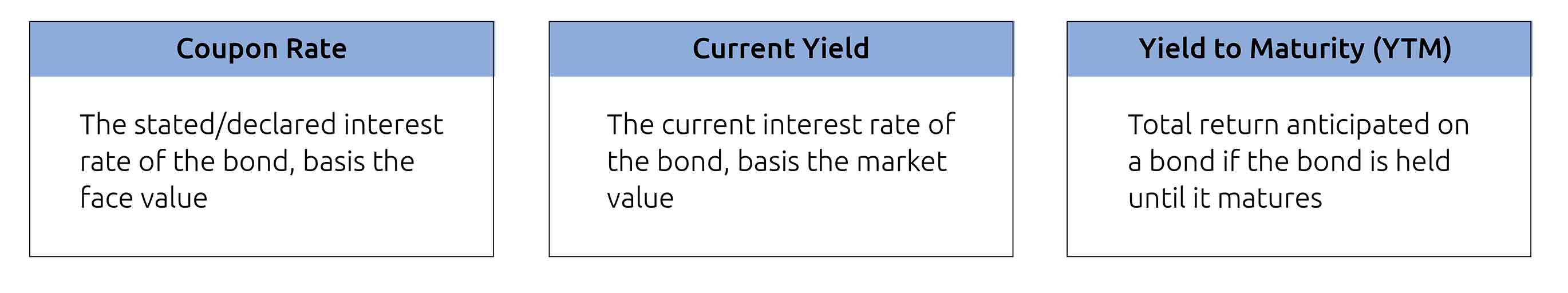

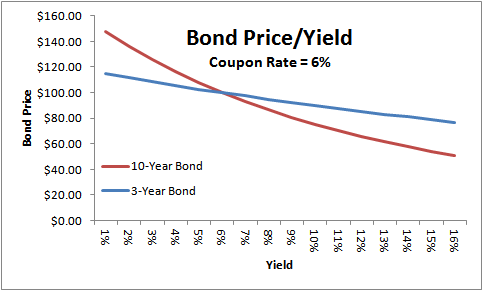

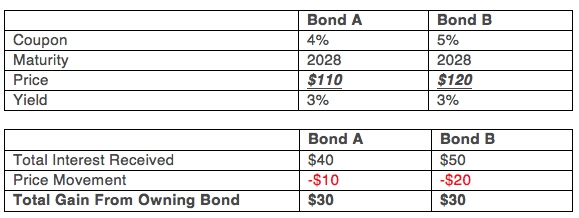

Current Yield Formula | Calculator (Examples with ... - EDUCBA Based on the fact that whether its coupon rate is higher, equal or lower than the prevailing market yield, the bond will be traded at premium, par or discount respectively. Step 3: Finally, the formula for a current yield of the bond can be derived by dividing the expected annual coupon payment (step 1) by its current market price (step 2) and ... Concept 82: Relationships among a Bond’s Price, Coupon Rate ... Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. A bond is priced at a discount below par value when the coupon rate is less than the market discount rate.

Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated ...

Coupon rate and yield

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ... What is the difference between coupon and yield? - IndiaInfoline The difference between coupon and yield is that coupon refers to the stated interest rate payable each year, while yield refers to the actual return an investor ... Bond Prices, Rates, and Yields - Fidelity Investments Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. That's because each year the bond or CD will pay a higher ...

Coupon rate and yield. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon rates are the yields associated with regular interest payments made by bonds and are influenced by prevailing interest rates. · A bond's yield is the rate ... Yield curve - Wikipedia In finance, the yield curve is a graph which depicts how the yields on debt instruments - such as bonds - vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (89 / 1000) * 100; Coupon Rate= 8.9%; For Unsecured NCDs. Coupon Rate = (91 / 1000) * 100; Coupon Rate= 9.1%; As we know, an investor expects a higher return for investing in a higher risk asset. Hence, as we could witness in the above example, unsecured NCD of Tata Capital fetches higher return compared to secured NCD. Explanation

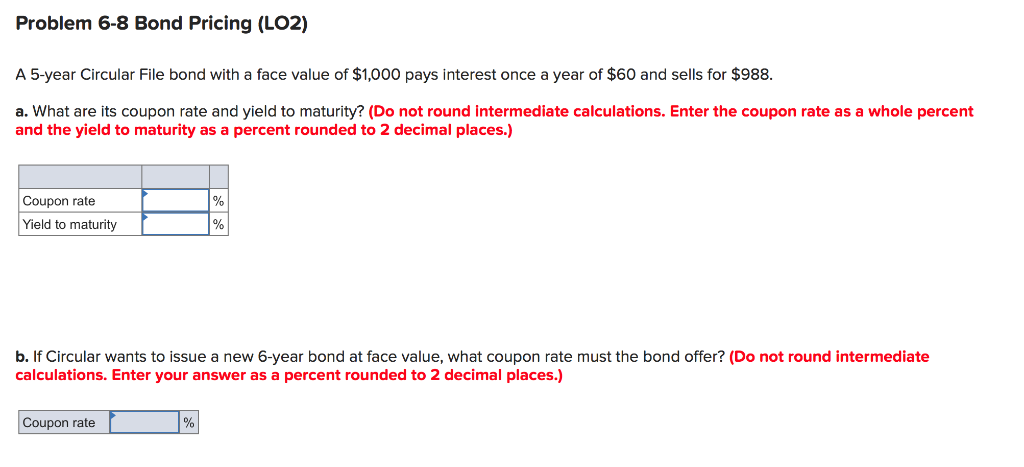

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond(at par). While yield to maturity defines that it's ... Coupon vs Yield | Top 5 Differences (with Infographics) The coupon is similar to the interest rate, which is paid by the issuer of a bond to the bondholder as a return on his investment. The yield to maturity of a ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... Yield to Maturity (YTM) – This is the total return investors earn when they hold the bond until it matures. Like the coupon or nominal yield, ... When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · When a Bond's Yield to Maturity Equals Its Coupon Rate . If a bond is purchased at par, its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by ...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ... Difference between Coupon Rate And Yield To Maturity - Angel One The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to ... Bond Prices, Rates, and Yields - Fidelity Investments Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. That's because each year the bond or CD will pay a higher ... What is the difference between coupon and yield? - IndiaInfoline The difference between coupon and yield is that coupon refers to the stated interest rate payable each year, while yield refers to the actual return an investor ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ...

Post a Comment for "45 coupon rate and yield"