40 ytm for coupon bond

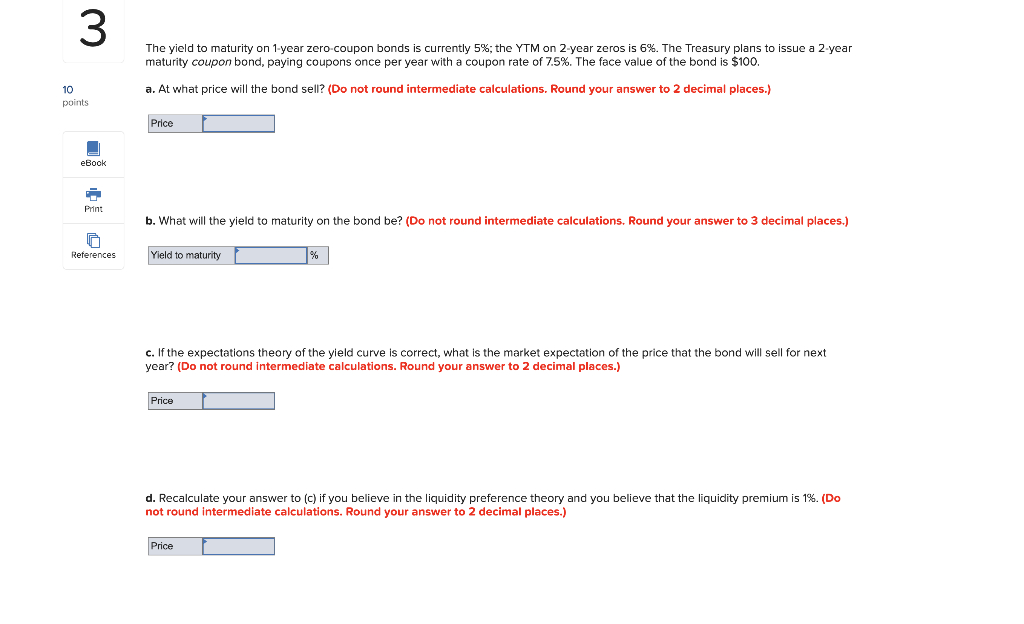

Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments. Yield to Maturity (YTM): Formula, Meaning & Calculation As Debt Funds invest in multiple Bonds, so the Yield To Maturity (YTM) of a Debt Fund is the weighted average yield of all the Bonds included in the scheme's ...

Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2.

Ytm for coupon bond

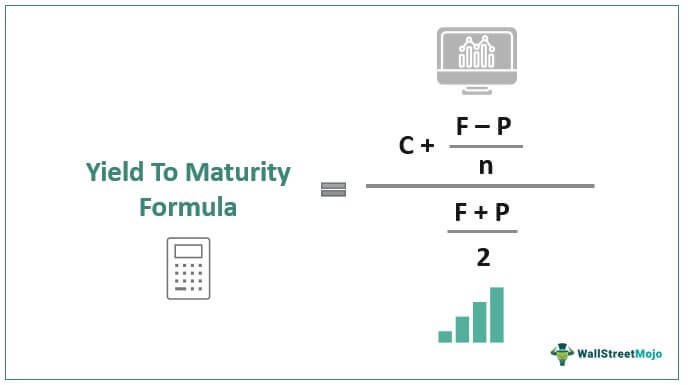

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow The coupon payment is $100 ( ). The face value is $1,000, and the price is $920. The number of years to maturity is 10. [2] Use the formula: Using this calculation, you arrive at an approximate yield to maturity of 11.25 percent. 3 Check the validity of your calculation. Plug the yield to maturity back into the formula to solve for P, the price.

Ytm for coupon bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics. When a bond is issued, the issuing ... Yield to Maturity – YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at ... Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments. r = discount rate (the yield to maturity) F = Face value of the bond. n = number of coupon payments. What is YTM in bonds? - Fintrakk YTM will be 90/950= 9.47%. Scenario-3 ( At a Premium) If you purchased the Bond at a premium of Rs80 of the face value of Rs 1000, having a coupon rate of 9% and maturity of 1 year then the yield will be, Interest received= Rs 90 Purchase price= Rs 1080 YTM= 90/1080 = 8.33%. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon... Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate.

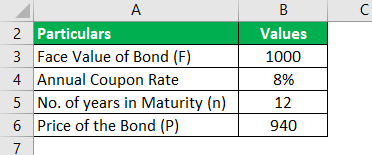

Yield to Maturity (YTM) Calculator Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2. Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

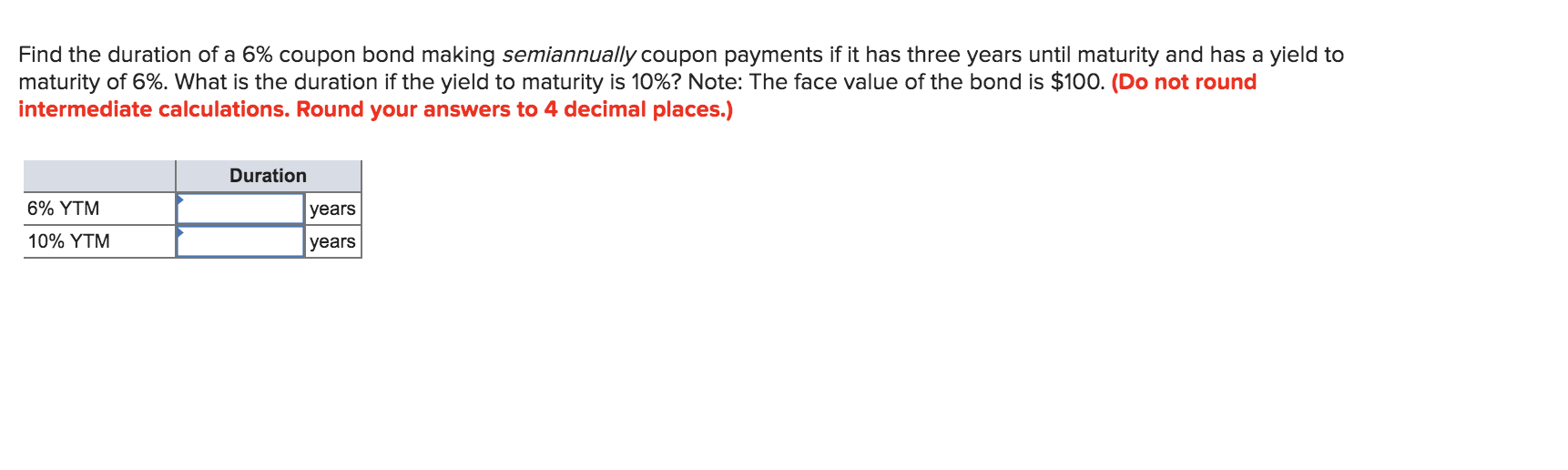

Yield to Maturity (YTM) Approximation Formula - Finance Train F = Face Value = Par Value (Usually $1,000) P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity. Let's take an example to understand how to use the formula. Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below:

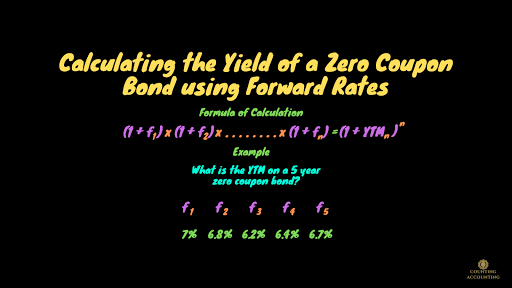

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

The Returns on a Bond - YTM - The Fixed Income The yield to maturity of a bond might not be the same as the coupon, or interest rate paid out on the bond. ... price considers that between the current rate of 8% and the coupon of 10% there are Rs. 20 extra that will be paid as a coupon on the bond, and Rs. 13.42 less than the amount paid now that is received on maturity. ...

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Annual YTM will be - Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%. Option 2 Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually. Yield to Maturity (Approx) = (42.50 + (1000 - 988) / (10 * 2))/ ( ( 1000 +988 )/2)

YTM for a 0-coupon Bond with <1 year until Maturity : r/bonds YTM for a 0-coupon Bond with <1 year until Maturity. Anyone mind helping me walk through this calculation? I can't quite arrive at my broker's number, so I am trying to reverse it back out but still can't get this exact. For reference, the bond I'm referring to: Face Value: $75,000. Price: $73,620. Purchase Date: 9/15/22.

Yield to Maturity (YTM) - Overview, Formula, and Importance 7 days ago — The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ...

Yield to Maturity (YTM) - Wall Street Prep In our hypothetical scenario, the following assumptions regarding the bond will be used to calculate the yield-to-maturity (YTM). Face Value of Bond (FV) = $1,000 Annual Coupon Rate (%) = 6.0% Number of Years to Maturity = 10 Years Price of Bond (PV) = $1,050 We'll also assume that the bond issues semi-annual coupon payments.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. · YTM takes into account the regular coupon ...

Calculate the YTM of a Coupon Bond - YouTube This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a financial calculator. Show...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds [ edit] Example 1 [ edit] Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/ (1.1) 30 = 5.73).

Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia To calculate YTM here, the cash flows must be determined first. Every six months (semi-annually), the bondholder would receive a coupon payment of (5% x $100)/2 = $2.50. In total, they would...

Yield to Maturity (YTM) of an annual coupon bond - YouTube Learn how to calculate yield to maturity (YTM) of an annual coupon bond. @RK varsity

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow The coupon payment is $100 ( ). The face value is $1,000, and the price is $920. The number of years to maturity is 10. [2] Use the formula: Using this calculation, you arrive at an approximate yield to maturity of 11.25 percent. 3 Check the validity of your calculation. Plug the yield to maturity back into the formula to solve for P, the price.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2.

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Post a Comment for "40 ytm for coupon bond"